The Best Guide To Estate Planning Attorney

The Best Guide To Estate Planning Attorney

Blog Article

Rumored Buzz on Estate Planning Attorney

Table of ContentsLittle Known Questions About Estate Planning Attorney.Not known Factual Statements About Estate Planning Attorney Our Estate Planning Attorney PDFsEstate Planning Attorney Can Be Fun For Everyone

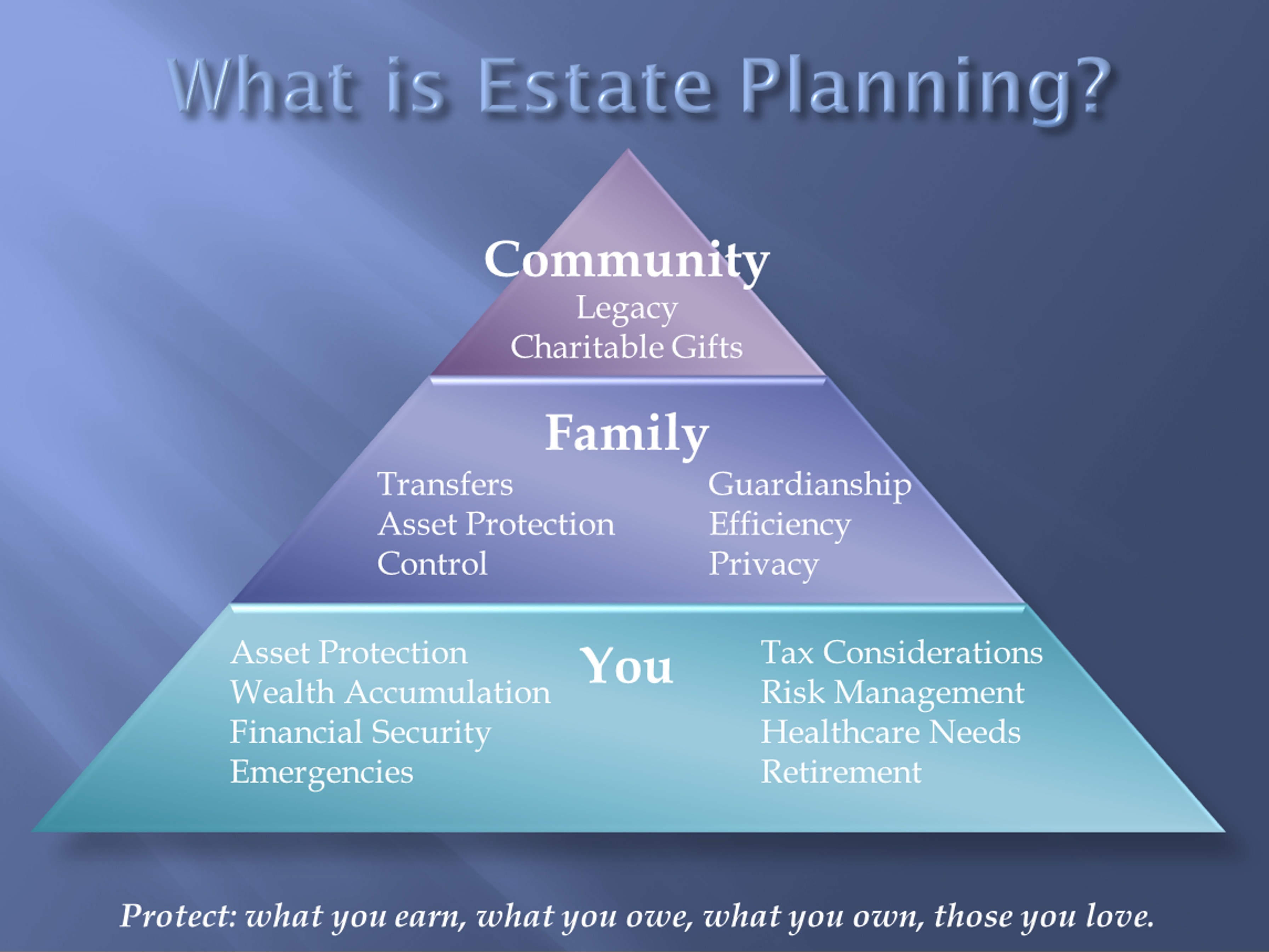

It's likewise necessary for any person with dependents, such as minor kids, liked ones with special needs, or aging parents - Estate Planning Attorney. Prepping for your very first estate planning meeting can feel challenging, yet it does not need to be. Think about the four adhering to actions to plan for the estate preparation procedure, total with expert recommendations

It's important to function with an attorney or law company experienced in estate law, state and government tax preparation, and count on administration. You may additionally ask your company if they supply a lawful plan advantage, which could link you with a network of knowledgeable estate planning lawyers for a low month-to-month charge.

Download electronic files to the cloud and check difficult duplicates so if anything goes missing, you have a back-up at your fingertips. Having discussions with the people you like about your own passing away can feel unpleasant. It's a significant subject and there's a lot to go over. The structure of your estate plan starts by assuming through these challenging scenarios.

Estate Planning Attorney - An Overview

Now, there's just one step left: thinking of questions to ask your estate attorney (Estate Planning Attorney). Zimmet claims to consist of these 6: What properties should belong to my estate? What are the tax effects of my favored estate strategy and exactly how can I decrease my tax obligation problem? Exactly how do you ensure my will is performed appropriately? How much time does the estate planning procedure require to complete? Where should my files be stored? How do you manage updating my estate strategy, and do you perform periodic testimonials? Zimmet notes that your estate intending lawyer must welcome your concerns, offer solutions that you recognize fully (not speak in legalese you can't equate), and make you feel comfy.

Whether you're simply beginning the estate preparation procedure or wish to modify an existing strategy, an estate preparation attorney can be a vital resource. You may think about asking close friends and coworkers for recommendations. However, you can additionally ask your employer if they provide lawful plan advantages, which can assist connect you with a network of experienced lawyers for your legal requirements, including estate planning.

You likely understand what you intend to you can check here occur to your assets, and to whom they need to go. An estate preparation attorney need to pay attention to your preferences and explain the choices for completing your objectives. When someone passes away and does not have a legitimate will and in place, the end result depends on the hands of the court and an unfamiliar person typically makes these choices.

The Definitive Guide for Estate Planning Attorney

While this is far better than absolutely nothing, there look at this now is no means of knowing how this will stand up in court if challenged. Furthermore, you lose out on most navigate to this website of the advantages you get when you collaborate with an estate planning attorney. These advantages may include: Obtaining guidance concerning your estate based upon the details of your monetary circumstance Aiding you consist of all feasible assets in your strategy Discussing exactly how tax obligations might affect the inheritance of your enjoyed ones Medicaid preparation and property defense based on your distinct circumstances Developing a robust, legitimate will Comfort from understanding there is a plan in place if you can no much longer make these choices or after you die Bratton Legislation Group handles estate planning with an interdisciplinary method.

Call us today at to get started. An administrator's job comes with several lawful responsibilities. Under certain scenarios, an executor can even be held directly liable for unpaid estate tax obligations.

An executor is a person or entity you pick to accomplish your last dreams described in your will. Your executor needs to be a person you depend on is responsible enough to manage your estate after you pass Every year hundreds of visitors cast their votes for the attorneys they contact in times of requirement and for the 8th consecutive year, we are recognized to say that attorney Chris Bratton has actually been nominated.

Not known Facts About Estate Planning Attorney

That's why when you're all set to make your last arrangements, your best option is to talk to an Arizona estate preparation lawyer at Brown & Hobkirk, PLLC to see to it everything you've made will go to those you intend. Ensuring this paper is properly composed, authorized, and performed is an essential feature of an estate attorney.

For instance, you may have a Living Depend on composed throughout your lifetime that offers $100,000 to your child, but just if she finishes from college. There are some documents that enter into effect after your fatality (EX: Last Will and Testimony), and others that you can utilize for clever possession monitoring while you are still alive (EX-SPOUSE: healthcare regulations).

As opposed to leaving your household members to guess (or suggest), you must make your objectives clear currently by functioning with an estate planning attorney. Your attorney will help you draft healthcare regulations and powers of lawyer that fit your way of living, assets, and future goals. The most typical method of preventing probate and estate tax obligations is via making use of Depends on.

Report this page